5 Apps to Help Maximize Your Credit Card Rewards

For people who pay off their balances every month, credit cards can be rewarding. Between free flights, cash back and a slew of other discounts, the perks of using credit cards for everyday expenses can add up quickly.

Unfortunately, keeping up with all those perks can feel like a full-time job. Several apps now hope to help. By tracking everything from cash back offers to miles and rewards points these apps promise a pathway for maximizing discounts and rewards — if you can manage your spending.

“When shopping with a card, people tend to be more primed and ready to hit the "buy" button when they see a product that they like, in contrast to when they are shopping with cash,” says Sachin Banker, a University of Utah marketing professor who has studied how credit card use affects the brain’s reward systems.

For people committed to a zero-balance lifestyle, however, these top-rated, apps offer a way to squeeze even more value out of your credit cards — in many cases for free.

AwardWallet helps you track rewards

AwardWallet was one of the first credit card rewards-tracking apps on the market. Founded as a website in 2004, it now boasts more than 700,000 users and partnerships with more than 670 businesses ranging from credit cards to retail stores.

AwardWallet is made for travelers. It offers a single place to track credit card rewards, airline miles, hotel points, cruise rewards, and perks from retailer and restaurant loyalty programs. It also includes detailed information on point conversion rates and timelines as well as their estimated value.

The app allows users to add travel itineraries, insurance information, a driver’s license, even a vaccine card. The one thing this app won’t do, however, is tell you what credit card to use to get the most back from your credit card company.

AwardWallet’s free version is enough to track all of your awards. The paid version costs $30 a year and adds quicker balance updates and email notifications about expiring rewards.

MaxRewards maximizes cash back

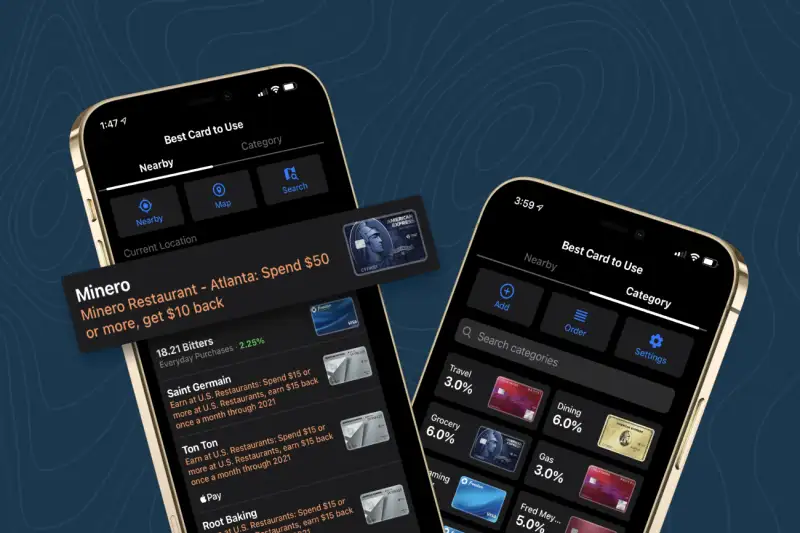

MaxRewards, which also offers free and paid versions, is designed to help users maximize cash back offers and select the best card for each purchase. It allows you to see which of your cards will give you the most back at the grocery store, which of your cards is best for gas, and which card you’ll want to use to pay for your vacation.

The app’s most useful feature, however, is that it shows you which of your credit cards to use at which businesses to get the most cash back. Users can see which cards offer the biggest rewards on which spending categories or search a map of nearby businesses. There’s also a search by address function.

It’s biggest drawback? MaxRewards only works with credit card issuers. You’ll need to find another way to track airline miles, hotel rewards, and retailer loyalty programs that aren’t linked to credit cards.

But if you’re looking to improve your credit score and manage your spending, MaxRewards may also help with that. It displays credit scores available through your credit cards as well as your credit utilization, which factors into your credit score. And it shows current interest rates on the cards in your wallet, key information for making any debt you do carry cheaper.

MaxRewards paid version, MaxRewards Gold, offers a sliding payment scale with a minimum price of $5 a month. The paid version automatically activates coupons linked to your cards from issuers including American Express, Chase, and Citi. It also sends notifications about new and expiring offers.

If all you want is to know what card to use for what purchases, the free version has you covered.

Mint, if don't want another app

If you’re a Mint user and experiencing app overload, there is a way to track at least some of your credit card rewards in Mint.

The free budgeting app allows users to connect all of their financial accounts in a single place. It’s intended to help people track their spending and saving to meet their budget goals, and some users have found a hack to incorporate credit card rewards into the mix.

Mint pulls in the statement credits from any credit card rewards you redeem for cash payments on your account. To add earnings from percentage-back offers, some users manually add additional categories to track inflows.

CardPointers, for new offers

CardPointers puts new customer credit card bonuses front and center by highlighting the top 10 offers each month. The app also tracks how much you’re spending on fees each year and surfaces offers linked to your cards.

A Pointers category shows you which of your cards are best for which purchase categories.

Uthrive, for not missing out

Uthrive, which launched late last year, is one of the newest credit card rewards apps out there.

It shows users how much they’re missing by not putting their purchases on a different credit card. “Not many people know how much money they’re leaving on the table,” said Uthrive founder Sameer Gupta, who spent nearly a decade working for American Express.

Uthrive shows when you’re earning the maximum for a purchase and recommends cards that could offer a better return on their spending. It can also track rewards linked to business cards.

Whichever app you choose, paying your credit card balance in full every month is key to squeezing more value out of them.