How to Build Credit With a Secured Credit Card

If you live in the U.S, building credit and having a good credit score is essential to most major life purchases like buying a car or home. But it's hard to get approved for products that build credit if you don't have any to begin with. That's where tools like secured credit cards come in handy.

A secured credit card works by allowing you to put down a deposit to serve as collateral for the lending agency, making it a much safer option than a typical credit card for both you and the lender. Because of this cash deposit, you’re more likely to be approved by the credit card company and be able to start fixing or building your credit. As long as your account stays in good standing, the card issuer will usually return the deposit after a certain number of months or when you close the account.

But just because secured credit cards are a good way to build credit without the risks of a typical unsecured credit card doesn’t mean they’re a miracle fix — you have to go about it the right way if you want to use one to repair or increase your credit score. Here’s how you can get a secured credit card and use it to build credit:

Why does your credit score matter?

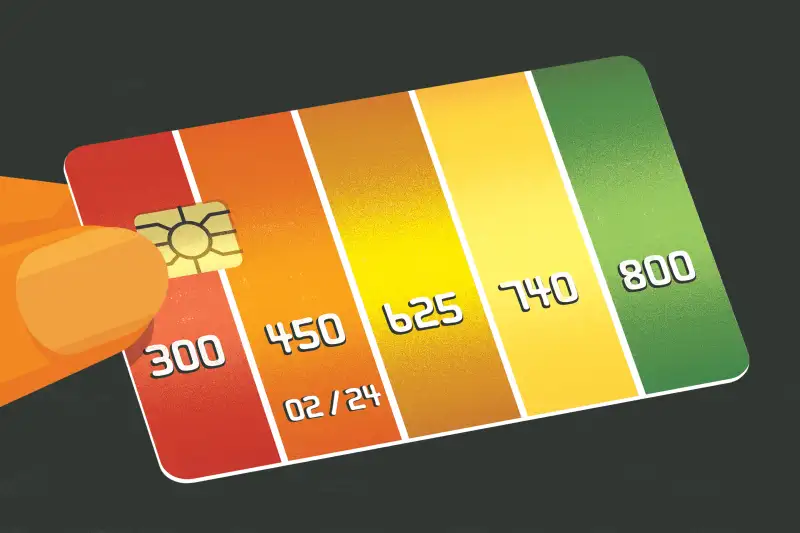

A credit score is a three-digit number given to consumers based on information gathered from credit reporting agencies that determines your creditworthiness. It helps lenders decide how much money to give you and at what terms/rates, based on the risk you pose as a borrower.. Factors that make up your overall score include your credit history (how long you’ve had lending accounts), your credit utilization rate (the ratio between how much credit you actually use vs. how much you have) and your payment history.

Any lending product you have in your name, such as credit cards, mortgages, car loans and student loans will be included in the credit report, which then determines your credit score. So if you default on a loan or carry a large balance on your credit card, it's going to impact your credit score* and potentially keep you from being able to access loans or even renting a home.

It can be even more difficult for those with little or no credit history: According to a 2015 report from the Consumer Financial Protection Bureau, around one in 10 Americans are considered “credit invisible,” meaning they don’t have enough of a credit history to even generate a score. Without a credit score, you likely won’t be able to access any lending products at all, which is why secured credit cards are a particularly advantageous starting (or re-starting) point.

How can a secured credit card help you build credit?

Aside from the initial deposit, secured credit cards help you build credit in the same way any other credit card does: by making purchases with the card and then paying it back on time each month.

You should only spend less than you can afford to pay back: So if your secured credit card has a monthly limit of $500, your aim would be to spend less than $150 each month. You also want to be sure you never spend more than you can afford to pay back — even if that means spending well below the recommended 30% utilization ratio. Making payments on time every month and keeping your utilization ratio low will help to improve your credit score over time.

Many people even set up just one or two strategic recurring payments to their secured card each month and nothing else, so they’re never surprised or scraping for cash when the bill is due. For example, you could charge just your $60 monthly internet bill to the card, pay it off, and still build a decent credit score over the course of a year or two.

Can a secured credit card further damage your credit score?

A secured credit card is not a Get Out of Jail Free card: The security deposit simply protects you from being sent to collections if you stop making payments, unless your defaulted balance is more than the deposit itself. Missing or late payments will still negatively affect your credit score, rendering the benefits of a secured credit card useless.

Secured credit cards also don’t tend to offer very competitive interest rates, meaning they’re usually much higher than a typical card. If you don’t pay off the balance of your card in full each month and let interest accumulate, you could end up having a balance much higher than the original, once again damaging your score.

Additionally, minimum security deposits for secured credit cards are typically around $200 or $300 (though it is possible to find cheaper options) and you need to provide it as soon as you’re approved. If not, the lender won’t issue the card and, seeing as the application process will likely have knocked your credit score down a few points thanks to a hard credit check, you will end up with a lower credit score than you began with.

If you don’t have the money for the security deposit, then you’ll need to save up for it before applying to avoid this situation. Or alternatively, if you already have other outstanding balances that could benefit from an extra $300 payment, it may be a better idea to fix your credit score by paying down that debt rather than taking out another line of credit.

How to choose the right secured credit card for you

On top of the security deposit, some secured credit cards come with annual fees as high as $50 a year, as well as potential application and processing fees. You can avoid paying many of these fees as long as you find a card that strikes the right balance of benefits and affordability. At minimum you need to be able to comfortably cover the cost of the security deposit, fees and monthly payments if the secured card is to help you build credit.

One other important thing to note: Some secured credit cards marketed toward people with bad credit don’t actually report to any of the three credit bureaus. That means if you use one of those cards, none of your activity will be counted toward your credit score, effectively rendering the card useless if your goal is to use it to build credit. To avoid this, make sure to do your due diligence by reading through every card’s fine print when shopping around. Contact the lender if it still doesn’t seem clear.

Moving to an unsecured or “regular” credit card

Some secured credit card lenders will allow you to convert the account to an unsecured card (aka one that doesn’t require a down payment) once your credit score is considered “fair” or “average.” In other instances, you might have to apply for an unsecured card on your own and close the secured account.

Under either circumstance, it’s important that you’re set up for success before making the switch. While they may come with more perks and less limitations, using an unsecured credit card can put you at risk for landing right back where you started by damaging your credit score. If you don’t trust yourself to not overspend or worry you won’t consistently have enough money to make payments on time, you’re better off sticking with the secured card.

More from Money:

How to Build Credit Fast and Earn a Good Credit Score