Here's What Happens to Your Student Loans If You Take a Year Off From College

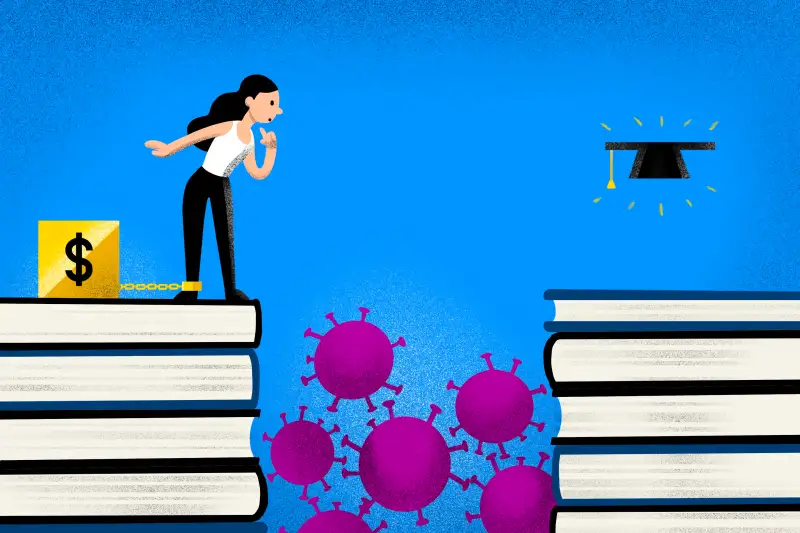

The coronavirus crisis has turned the world upside down, and higher education is no exception.

About 30% of Americans say the coronavirus may cause them to either cancel or change their plans for education or job training this year, according to a weekly poll from Strada Education Network, which researches education and employment.

And traffic for a website devoted to exploring and planning a “gap year” increased up to 150% since the coronavirus was declared a pandemic, says Ethan Knight, Executive Director of the Gap Year Association.

A year off can be appealing right now for students who don’t feel like shelling out tens of thousands of dollars if colleges end up having to offer classes only online. For others, it may be necessary if they have had a significant financial shift or health issues.

But if you take time off, will you have to begin repaying your student loans?

With federal student loans, as long as you’re enrolled at least half-time at a college, your loans are placed in what’s called an “in-school deferment.” That means you don’t have to pay anything until you leave school.

Scott Buchanan, executive director of Student Loan Servicing Alliance, says while taking time off right now can seem like a good idea, the federal student loan program really has been focused on encouraging borrowers to persist in getting their degree.

That’s because students who “stop out” of college, or leave intending to return, can easily turn into dropouts. And college dropouts tend to fall behind on their loans.

“Those who leave school for a time are most likely to default and so it’s financially generally better to complete a degree and move forward,” Buchanan says.

He also points out that while the federal system gives all borrowers who leave college at least a six-month grace period before payments are due, you only get one grace period. So if you use up the full grace period, then return to college and graduate, your loans will come due immediately. (If you re-enroll before using the full grace period, it will reset, according to Mark Kantrowitz, publisher of Savingforcollege.com.)

Buchanan recommends students talk to their financial aid office to understand the affects of the choice since, besides student loans, it also can change grants, scholarships and institutional aid.

If you do decide to take a semester or year off, you have some options for how to handle your student loan payments.

Travis Hornsby, founder of Student Loan Planner, recommends students with federal student loans enrolling in an income-driven repayment plan. Since the payment will be based on last year’s tax return, the monthly payment could be as low as $0, if the borrower didn’t work.

There are also options to apply for an unemployment deferment, an economic hardship deferment or forbearance on federal student loans.

For most of the deferment and forbearance options, as well as a low monthly payment on an income-driven repayment plan, interest will continue to accrue and increase your total debt. If you can afford it, talk with your servicer about making payments just to cover the interest.

“When (students) return to school more than half-time their federal loans will go back into an in-school period where they are not obligated to make payment,” Buchanan says.

However private student loans could be a little trickier since there usually is not an option to make payments based on your income and the option to defer loans may be limited or not available at all, depending on the lender.

Kim McNealy, chief marketing officer at Ascent Student Loans, says the lender hasn't seen evidence that any of its borrowers will take time off next year yet.

But to help students during the current health crisis, Ascent launched a new Declared Emergency Forbearance option that allows students to pause payments for up to 3 months. Like other private lenders, there are options for a temporary hardship forbearance, too. As with federal loans, most payments will begin 6 months after a student leaves school. You’ll have to call your private lender to see what specific options are available if you take time off.

This article has been updated to clarify that if a borrower re-enrolls before the grace period ends, the full grace period is restored.

More from Money:

What to Know Before You Take a Gap Year From College During Coronavirus

Here's How College Admissions Are Changing This Year — and What High School Seniors Need to Know

Coronavirus Is Upending Internships for College Students. Here's What to Do If Yours Was Canceled